Week 1: Introductions

Time: 01/21-01.24, 19.5 hours

Topics: A Christian Perspective on the Insurance Industry.

Tools: Laravel, Prismic, Gatsby, GitHub, Netlify.

Summary:

The first week of my internship was spent setting up my accounts for the different tools Wunderite uses for their marketing site and web application. The marketing site is built with Gatsby, pulls content from Prismic, and is deployed via Netlify (This combination would soon blow my mind as one of the most powerful and fastest ways to deploy React apps). The web application is built using Laravel, its frontend is written in VueJS, and its backend in PHP. Throughout my internship, I would mostly be working on the marketing site and one of my first tasks was to make some fresh content changes on Prismic. This week I changed the look of the footer to accommodate new pages and got comfortable branching and pushing updated code to GitHub.

This was the first week of my internship so it is a good time to explain what Wunderite does, who’s behind it, and why they’re passionate about their product.

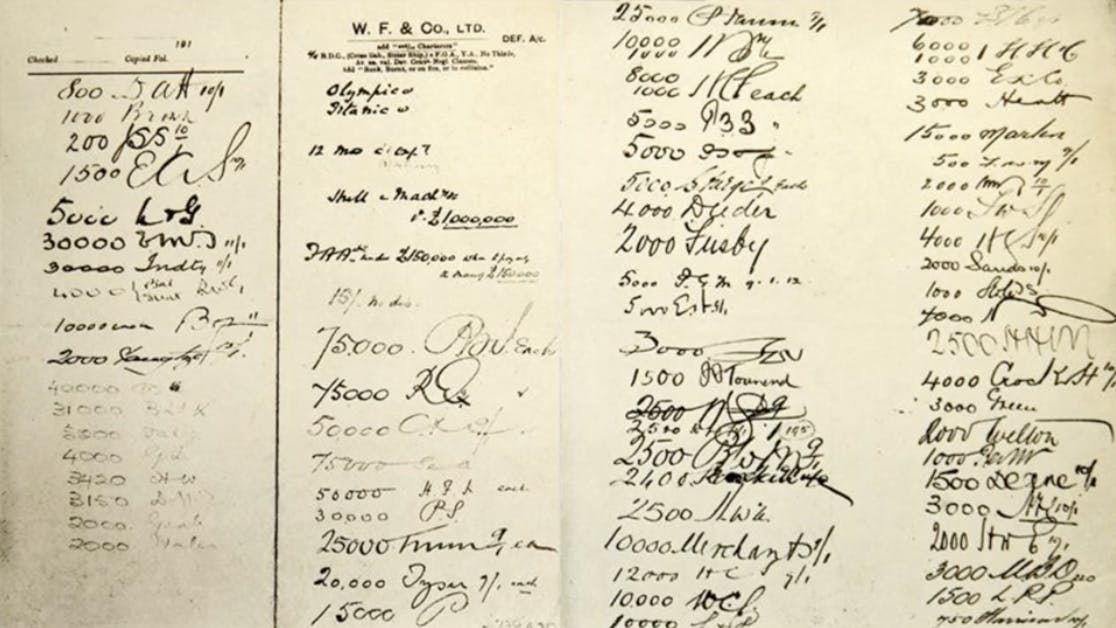

Peter started Wunderite because business insurance is complex and he wanted to make it simpler and more streamlined. A hundred years ago investors of the day would simply sign their name beneath a property description they wanted to insure, for example, here is the insurance policy for the Titanic:

What’s incredible about the simplicity of this is that it was fast. When the Titanic went down, it was paid in full in less than 30 days. Since 1912 a lot has changed. Since the Titanic, men have visited the moon’s surface, cars are driving themselves and the phones in our pockets are more powerful than the first computer scientists could have imagined. Something that hasn’t changed, or in fact became more tedious, is the way people purchase insurance. This troubled Peter and he set out to make purchasing insurance transparent, simple, and fast.

Peter uses the Titanic story as an example of how complex and slows the insurance process is today. If one wanted to ensure the doomed cruise ship, an insurance agent would begin an email chain between his customers and insurance carriers. The process is slow and opaque, Peter knows from experience that it could take up to 20 business weeks for a business to shop, quote, and bind business insurance. And at the end of the process, neither the customer or the insurance agent would know if they have the right coverage in place.

The question Peter asked himself and his co-founder, Joe Schnare, was: what would the process look like if they started from scratch today taking advantage of modern tech stacks and APIs? They decided it would be three things—easy, fast, and smart.

- Easy: The application would allow an insurance agent to invite their customer to collaborate on a policy with them in minutes, not weeks. Because it would be web-based, it would work on any device. Peter and Joe tested the first versions of Wunderite with legacy staff and new salespeople.

- Fast: Wunderite allows agents to pull hundreds of data points on businesses at the click of a button. Gone is the confusion and guesswork of paperwork and unorganized pdfs, the process is simplified and streamlined with data from useful APIs.

- Smart: Wunderite recommends which insurance policies to buy and gives key insights based on the data created by insurance agents. The insurance industry created the first fire departments and accelerated the development of incredible products like airbags. It built the logic behind the current vehicle and building safety standards that keep society safe. Peter believes its time that insurance agents had tools to unleash the power of their data, for example, Wunderite can help agents communicating what it means if a building isn’t sprinkled, or if a companies vehicles are middle age or have inexperienced drivers.

This all matters because insurance agents pride themselves on customer service. By removing the paperwork and simplifying the process, Wunderite makes it easier for insurance agents to understand their customers, to recommend the right insurance, and to show the customer actions they can take to run safer businesses. There are over 38,000 different agencies across the U.S. demanding better tools, and Peter and Joe are ready to build them. Wunderite is innovating in an industry that has hardly changed since the Titanic, they are building next-generation software for business insurance.

A Christian Perspective on the Insurance Industry: In the first section of his Essay, Can Money Buy Happiness? Dr. Enoch Hill outlines the significance of simple modern-day innovations like artificial light and the immense impact modern economic development has had on a countries GDP. Wunderite reflects this advancement revealing that the "reach of prosperity" does "extend beyond the tangible" (Hill, 4). Insurance is not material in the way cars, houses, and giant TVs are and Wunderite as a product is catching up to the increase in material prosperity over the past centuries.

TIMELINE.

These timeline posts were written mostly in hindsight and generated from my journal entries, a detailed timesheet, and any relevant screenshots/media I had saved that week.

← Scroll Left